Articles & News

dlgadmin On

Hiring Smart for your Business

One of the most important aspects of building a strong team and even stronger company culture is hiring smart for your business.

dlgadmin On

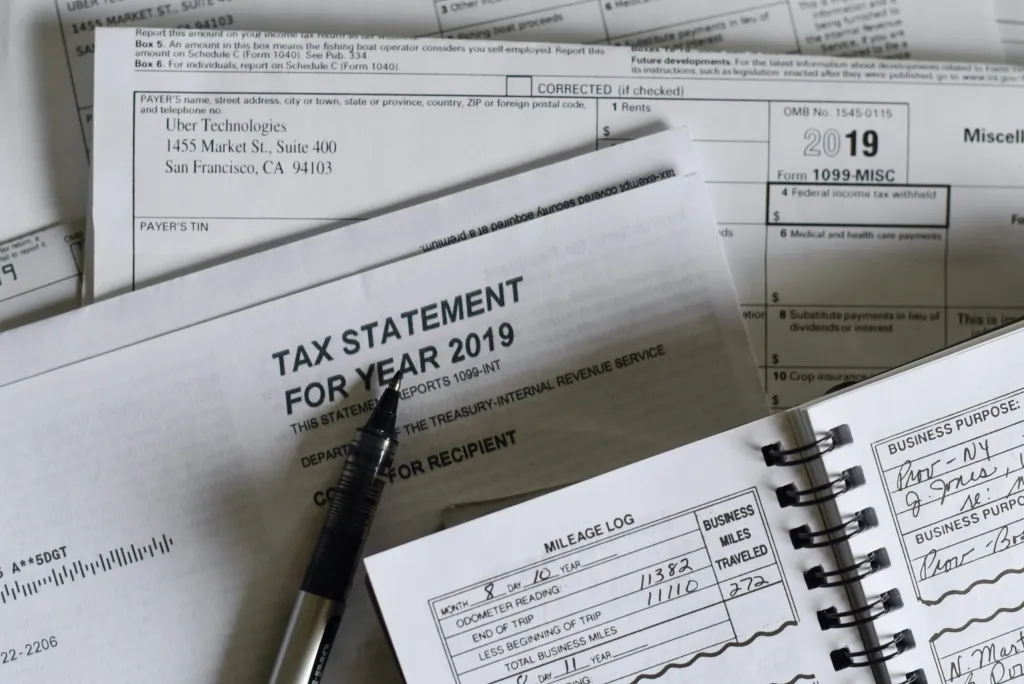

Opting Out of New Tax Rules After an Audit

Beginning in 2018, your partnership, limited liability company (“LLC”), or s-corporation (“S-Corp”) could be liable if an IRS audit reveals alleged underpayment in taxes. So here’s how to better prepare your business for potential IRS audits that may reveal an underpayment in taxes

dlgadmin On

Doing Business With an Institutional Investor?

In the investor realm, there are institutional investors and non-institutional investors. Even though both investors are just that, the business relationships between the two do not follow the same structure. This is due to the nature of the differentiating securities [investment] laws. If you’re a business seeking investment capital, it is important to note institutional

dlgadmin On

Dying Without a Will in Texas

“Who Will Inherit My Assets if I Die Without a Will?” This is a question I often get from clients. In the state of Texas, if you are survived by your family and do not have an estate plan, the state divides your assets based off of something called Intestate Distribution. Intestate Distribution is

dlgadmin On

5 Simple Steps to Help Kickstart Your Estate Plan

I haven’t had time to get around to it” “I don’t have enough assets to leave anyone” “Estate Planning is too expensive” “I don’t know how to get a will or living trust” Have you ever caught yourself saying any of these things when trying to reason with the fact that you still haven’t

dlgadmin On

The Basics of a Trust

For someone with one or more businesses, real property, or personal property, trusts can be a valuable tool. So, what is a trust? A trust is an estate planning tool used to manage your assets during life, after death, and to replace [or supplement] a will.

- « Previous

- 1

- 2

- 3

- Next »